Real estate investment firm Jones Lange LaSalle just came out with its Fall 2013 “Big Box Velocity Index.” It measures both building activity and demand for industrial warehouse space across the U.S. The report suggests the economy is rebounding, with demand for warehouses strong across the country, especially for buildings over 500,000 square feet. According to the report, the overall industrial vacancy rate is the lowest since the 2nd quarter of 2008.

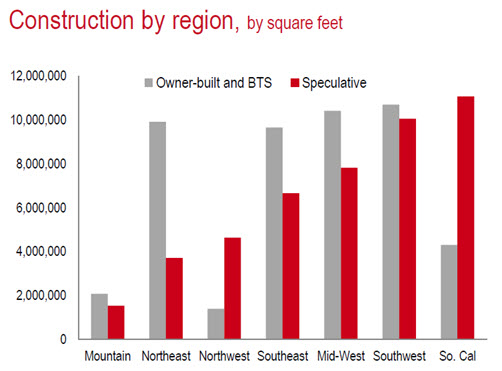

Southern California’s Inland Empire region leads the nation in occupancy gains in 2013, with 10.2 million square feet of space leased for Inland Empire commercial warehouse property. Demand has since tapered off since this heavy period of leasing activity. The region also leads the nation in industrial construction activity in 2013, as shown on the chart below.

Real estate developers have done their research and are clearly confident that the Inland Empire will continue to be a distribution hub of choice for the foreseeable future. This active investment is being made despite talk that nearshoring and the Panama Canal expansion will draw goods away from Southern California ports, and therefore away from nearby distribution warehouses.

Here’s why we feel that is unlikely:

- Inventory carrying costs would rise. Southern California ports are the closest distance from Asia to the U.S. It would take up to 2 weeks longer to ship goods to an East Coast port. This added cycle time could increase inventory carrying costs by as much as 30%. Read more about this in our Insight paper: Panama Canal Expansion: Impact on the Volume of Imports to Southern California.

- Ship line costs would rise. The China to SoCal ship lane is more efficient for shipping companies. Any changes the shipping lines make to lane volume away from SoCal will be reflected in much higher shipping costs. Shippers won’t like that.

- Relying on Eastern ports would increase risk. Eastern ports simply don’t yet have the deep water capability and supporting logistics infrastructure that Southern California has been building for the last 50 years. Shifting cargo to ports with a “developing” capability involves risk, and shippers don’t like risk.

Another interesting finding from the Big Box Velocity Index is the fact that Phoenix tops the list of 2nd tier markets where demand for warehouse space exceeds current supply. Weber operates a Phoenix warehouse and freight terminal for our temperature controlled LTL delivery network.

Numbers from the Big Box Velocity Index indicate a growing economy, and that Inland Empire commercial warehouse development is continuing at an aggressive pace.

Capital Management

Capital Management