Retailer chargeback fines for non-compliant shipments are a profit-draining reality for many consumer goods manufacturers.

Retailer chargeback fines for non-compliant shipments are a profit-draining reality for many consumer goods manufacturers.

But they don’t have to be.

Companies with the will and the resources to prevent and refute chargebacks can avoid hundreds of thousands, even millions, in lost profit. Success requires creating a retail compliance capability – either internally or through a partnership with a 3PL experienced in retail distribution.

Following are tips for avoiding these costly penalties. For our complete 7-step process to reduce chargebacks, read our Weber Insight paper on retail compliance.

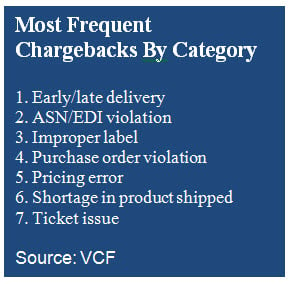

Most frequent chargebacks

1. Quantify the financial impact of chargebacks.

Arrive at one, definitive and defensible number for your total chargeback costs. This won’t solve the problem, but it will position you better to win support for investments in the people and systems you may need. The information may be easier to get than you think. Accounting typically provides a report to logistics or the distribution center on chargebacks received. This will identify costs directly related to invoice reductions.

2. Invest in an advanced warehouse management system (WMS).

Staying one step ahead of retail compliance requirements without an advanced WMS is like racing the Indy 500 in your dad’s Buick. It’s not a race you’re going to win. Any paper-based process will require significant labor to stay compliant. And no amount of checks and re-checks will eliminate human error entirely. You need a WMS to automate distribution and data transfer tasks or partner with a 3PL whose systems are designed to support retail compliance.

3. Get EDI right

After early/late deliveries, by far the biggest source of retail chargebacks is late, unreadable, or incorrect advance shipping notices (ASNs) – information transmitted to a retailer in advance of delivery that details the products and volumes in the shipment. Address the ASN problem and you’ve licked a good percentage of your chargeback issues.

4. Make compliance someone’s full or part-time job.

Who owns vendor compliance? Logistics? Sales? Accounts Receivable? With no clear owner, there is no clear plan. With no clear plan, compliance deteriorates into a cycle of repeated violations and finger-pointing. Don’t have the resources to handle this internally? The right 3PL can take on shipping compliance requirements, allowing you to, in a sense, outsource vendor compliance.

Capital Management

Capital Management